Insider trading is a term that often conjures images of high-stakes finance, secretive meetings, and the potential for massive financial gain. Yet, behind the allure of quick profits lies a serious legal landscape that can lead to significant prison sentences for those found guilty of this crime. In the world of finance, insider trading is considered a severe infraction, as it undermines the integrity of the market and harms investors who rely on transparent information. Understanding the ramifications of engaging in such illicit activities is crucial for anyone involved in trading or investment.

When individuals are privy to confidential information about a company's performance or activities, using that knowledge to benefit their own financial positions raises ethical questions and legal issues. Enforcement agencies, such as the Securities and Exchange Commission (SEC), take these violations seriously, ensuring that those who engage in insider trading are held accountable. As a result, many wonder: how many years in prison for insider trading can one expect if convicted?

While the specific sentence can vary based on multiple factors, including the severity of the offense and the offender's prior criminal history, it is essential to grasp the gravity of insider trading. In this article, we will explore the legal consequences of insider trading, the factors that influence sentencing, and provide insights into high-profile cases to clarify the question: how many years in prison for insider trading?

What is Insider Trading?

Insider trading refers to the buying or selling of stocks based on non-public, material information about a company. This practice is illegal and can lead to severe penalties, including imprisonment. The information can come from various sources, including company executives, employees, or even friends and family who have insider knowledge.

What Are the Legal Consequences of Insider Trading?

When caught engaging in insider trading, individuals may face various legal repercussions, including hefty fines, civil penalties, and prison sentences. The SEC actively investigates and prosecutes cases of insider trading to maintain the integrity of the financial markets.

How Many Years in Prison for Insider Trading?

The length of prison sentences for insider trading can vary widely. Generally, sentences can range from several months to several years, depending on the severity of the crime. Factors influencing the sentence include:

- The amount of profit made from the insider trading.

- The offender's previous criminal history.

- The level of involvement in the crime.

- Whether the individual cooperated with authorities during the investigation.

What Factors Influence Sentencing for Insider Trading?

Several factors play a crucial role in determining how many years in prison for insider trading a defendant may face:

- Severity of Offense: The more substantial the financial gain, the harsher the sentence.

- Criminal History: First-time offenders may receive leniency compared to those with prior convictions.

- Cooperation: Those who cooperate with investigations may receive reduced sentences.

- Impact on Market: If the insider trading had a widespread impact, sentences may be more severe.

High-Profile Cases of Insider Trading

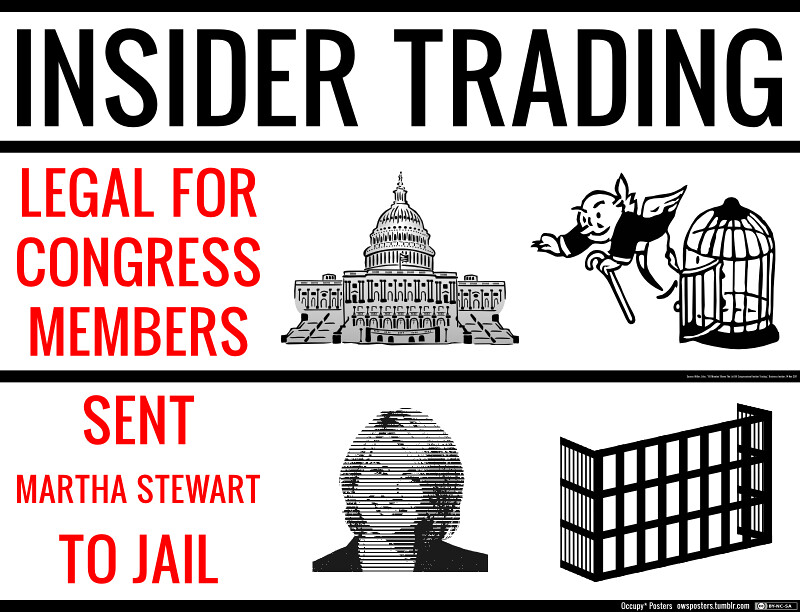

High-profile insider trading cases often attract media attention, showcasing the potential consequences of such actions. One notable case is that of Martha Stewart, a television personality and businesswoman who was convicted in 2004 for insider trading related to her sale of ImClone Systems stock. Stewart served five months in prison, highlighting that even celebrities are not above the law.

What Can We Learn from High-Profile Cases?

High-profile insider trading cases serve as cautionary tales for anyone in the financial sector. They illustrate that no one is immune to prosecution, regardless of their status. The consequences can be severe, and it is imperative to understand the risks associated with insider trading.

How Can One Avoid Insider Trading Charges?

To avoid the pitfalls of insider trading, individuals should adhere to the following guidelines:

- Always rely on publicly available information when making investment decisions.

- Avoid discussing sensitive information about a company with anyone outside of official channels.

- Consult with legal or financial advisors if uncertain about the legality of a trading decision.

- Be aware of the company’s policies on insider trading and comply with regulations.

Conclusion: The Importance of Understanding Insider Trading Laws

In conclusion, understanding the laws surrounding insider trading is essential for anyone involved in the financial markets. The question of how many years in prison for insider trading is a serious one, as the potential consequences can be devastating. By staying informed and adhering to legal guidelines, individuals can protect themselves from the severe ramifications of insider trading.

Whether you are a seasoned investor or someone just starting in the world of finance, always prioritize ethical practices and transparency. The risks associated with insider trading far outweigh the potential rewards, and the legal consequences can change lives forever.

Mom Helps Son With Hardon

Unveiling The Allure: The Intriguing Journey Of Zoey Deutch Nude

Unveiling Sherri Shepherd's Net Worth: A Journey Of Success